Repossession Management

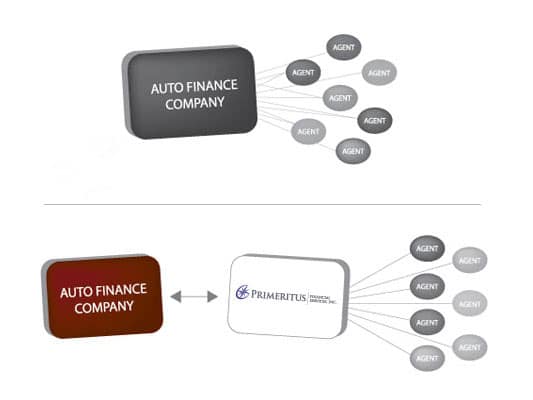

Primeritus Financial Service acts as an outsourced business partner for its lender clients by managing the repossession process for those clients not having the capabilities or desire to perform these functions in-house. Through proprietary methodologies and by leveraging a network of repossession firms across the country, Primeritus is able to centralize and manage the repossession process to ensure that our lender client’s collateral is recovered in an efficient and timely manner.

As part of our repossession management service offerings, we include a number of standard benefits:

- Flat-fee pricing to standardize your recovery and allow for accurate modeling through the recovery/remarketing process

- Dedicated Manager that reviews your portfolio daily to ensure performance and quality control

- National servicing of your accounts, including Alaska and Hawaii, all for one flat fee

- Client-centric teams that provide effective real-time communication with you as your account is being recovered

- Dedicated Impound team that handles the negotiation, payments, and release of collateral not in possession of our lender client’s customer – including the advance of all monies owed on the unit

- Remarketing group and assistance as necessary

- Transportation of all secured vehicles to appropriate auctions or storage locations